25 February 2022

Russia and Ukraine

I am writing to all our investors concerning the Russian invasion of Ukraine. As I write, the FTSE 100 and the Euro Stoxx Indices have steadied following the small losses yesterday and the Dow closed up slightly last night. That said, any blood on the carpet of the world’s exchanges is nothing compared with the real blood on the streets of Ukraine. This week’s events are horrible, in humanitarian terms, and a setback in humanity’s long, zigzagging and sometimes retreating march from barbarism to civilisation. Realistically, there is little each of us can do as individuals, save being prepared for whatever sacrifices events demand of us. We do not know yet what those will be, but higher prices, higher taxes and lower living standards are a fair bet. One thing we can all do, however, is staying calm to avoid financial self-harming. Historical perspective is invaluable. There is trouble in the world right now, sure, but there always has been. I was born nine months after the Cuban Missile Crisis and four months before JFK’s assassination. 1967 was the Arab Israeli Six-Day War, 1968 the Russian invasion of Czechoslovakia, and 1973 the Yom Kippur war. The news of my young years was Vietnam, Northern Ireland, the oil shock, rampant inflation, and perpetual industrial strife. 1979 was the Russian invasion of Afghanistan. The early 1980s saw NATOs face-off with Russia over Cruise missiles in Europe, and President Reagan’s ‘Star Wars’ Strategic Defense Initiative. Go back a hundred or five hundred years and you can make a similar list of wars and crises.

Beware Fake News

A few weeks back a Bitcoin-pusher was Tweeting a line that “All investors are selling shares to buy Bitcoin. They know the game’s up.” So, okay, let’s analyse that statement. It won’t take long. Every share that one investor sells, another buys. If every investor were selling shares, and nobody was buying, as that Bitcoiner claimed, no shares would or even could change hands, and the alleged sellers would have no money to spend on buying Bitcoin. It really is that simple. That is how easy such myths are to debunk. You just have to pause, think logically, and ask yourself the right questions. Time was when it was only possible to widely publicise a claim or opinion if you could persuade the media to print or broadcast it. In the late 1990s Anil Bhoyrul and James Hipwell, two unscrupulous journalists who wrote the Daily Mirror ‘City Slickers’ column, were buying shares before recommending them to readers, then selling out at a profit once the share price had risen. Convicted, Bhoyrul got 180 hours of community service and Hipwell three months’ jail. These days though, unfortunately, any crook, conspiracy theorist or idiot can broadcast anything via social media, however outrageous the lie, and unless they are a professional adviser regulated by the FCA they are unlikely to face any sanction whatsoever.

Don’t Be Bitten by the Gold Bugs, Don’t be Conned by the Crypto-Clowns

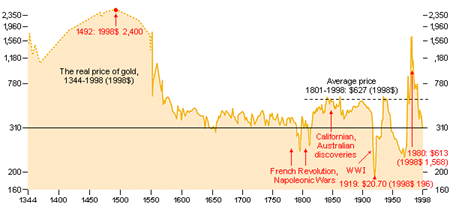

The gold bugs love a crisis. They repeat one mantra endlessly: That only gold is safe and ‘fiat currency’ is a government fraud. They say, “gold is a store of value” and point to the gold price as evidence they are right. Are they? Only in the sense that even a broken clock is right twice a day. Take a look at the graph below on the actual price of gold adjusted for inflation. Those who bought gold in the 1980 price spike have never gotten their money back in real terms, and their loss is even larger once the opportunity cost is taken into account.

The opportunity cost is the return they could have earned if they’d invested elsewhere, in shares, for example. Sure, shares can go down in value as well as up, but so can gold, and unlike gold, shares pay dividends. Gold produces no income and those who buy gold coins pay VAT on them. Events such as we are seeing in Ukraine increase market volatility. Nobody likes seeing their investments drop in value, but markets do take a tumble when a crazy dictator goes all Adolf. The absolute fundamentals, however, have not changed. Clients who invest in shares through the kind of funds we recommend, even small investors, become part-owners of dozens of enterprises worldwide, and larger investors can become part-owners of hundreds of companies. Those businesses provide the things that the seven billion people on the planet want and need. They dig minerals out of the grounds for metals like steel and aluminium. They provide fuels from oil and from new green technologies. They fill the supermarkets with food and drink and all the other stuff of daily life that you and other shoppers buy. This is the big and obvious difference between real asset-backed investments and cryptocurrencies, for anyone who takes a moment to think about it. Nothing, zero, backs cryptos like Bitcoin. There are no underlying companies making or selling things to generate profits. Their value relies solely on somebody wanting to own them. Everyone needs to buy groceries and most people need to fill up a car, but nobody needs to buy cryptos, or gold either, for that matter, unless they are manufacturing jewellers or a national mint knocking out Sovereigns or Krugerrands or suchlike. That, of course, is why Bitcoin’s fake news merchants, and the gold bugs, wage their constant propaganda campaigns consisting of ever more extravagant and ridiculous claims, hoping to sucker the faint of heart, to drive up the value of their own miser’s hoards.

I started this letter quoting the latest figures for the FTSE, Euro Stoxx and Dow. To put them in perspective, however, for any cryptocurrency fans that might be reading this, Bitcoin is down almost 50% from its high last November and the Moscow MOEX Index is down 43%. That tells you all you need to know as to what the Russians think of Putin’s war.

Need To Talk?

As in the crisis of 2008, the silly flap around the 2016 Brexit referendum result, and the ‘COVID-19 crash’ of 2020, I am here for any client who wants to talk things through. The office has been open and taking calls from 8am to 8pm all this week, and it will be next week also. Other firms’ normal nine-to-five hours are not our normal. Clients who need me at other times can get me on my mobile anytime.

What Are We Doing With Our Own Money?

Linda and I, with our own pension fund and other investments, are in the market. We are holding shares in companies worldwide, just like you. We are certainly not dashing for cash, or gold, or cryptos. The same goes for our colleagues. We do not tell them how they must invest. They make their own decisions and have access to all the same research we use for client portfolios. That is the same research that Linda and I use to pick funds for our own holdings. There are no ‘secret’ funds or strategies that we keep exclusively for ourselves. If clients are in them, we are in them. If we would not buy a fund for ourselves, we would not buy it for you. The only substantial difference between our own portfolio and that of the average client is that Linda and I have a higher personal risk tolerance than most clients. During the ‘COVID-19 crash’ our personal pension portfolio had dropped in value by £80,000 at its worst point. It wasn’t a problem. We didn’t flap. We knew that markets would recover. We stood back and took a long cool look and formulated our OPERATION MALLARD exercise. That accelerated our portfolio’s recovery, just as it accelerated the recovery of clients’ own portfolios.

Now, as then, we are watching for any opportunities that may present. As and when any do, we shall be in touch with any switch recommendations we feel are appropriate. In between times, if you would like a discussion at any time, please do not hesitate to call me.

With kind regards,

Yours sincerely

Neil F Liversidge Dip PFS

MANAGING DIRECTOR